Magnus Advisory: Your Financial Planning Advisor for Every Milestone

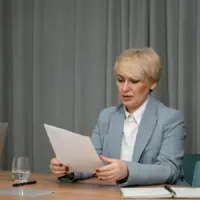

Our Experts

At Magnus Advisory, our personal financial planning experts specialize in creating customized solutions customized to your unique needs. Whether it’s a kids education plan, a retirement plan, or universal life insurance, we combine top industry knowledge with a client-focused approach to help you secure a worry-free retirement, boost your income, and build a confident future for you and your family.

Our Approach

Magnus Advisory is rooted in understanding your unique financial goals and building a strategy that evolves with you. As expert financial planning advisors, we focus on clarity, long-term value, and personalized guidance—ensuring every decision supports your future with confidence and purpose.

Our Commitment

Trust. Transparency. Results. That’s our promise as your financial planning advisor. Since 2014, we’ve put integrity first—building lasting relationships and driving success for every client we serve.

Services

Personalized Financial Planning Solutions for Every Stage of Life

Our Values

Core Values. Reliable Guidance.

Integrity

At Magnus Advisory, each financial planning advisor ensures that every recommendation is built upon honesty and full transparency. Our commitment goes beyond simply earning your trust—we honor it in every decision we make.

Client-Centricity

Your priorities guide Magnus Advisory’s financial planning advisors in shaping strategies just for you. We listen, respond, and customize every plan to reflect your unique values and vision, putting you at the center of everything we do.

Expertise

At Magnus Advisory, our skilled financial advisors simplify complex financial matters. We offer clear insights and personalized strategies, empowering you to make confident decisions and secure a strong, well-planned financial future.

Commitment

Since 2014, we have focused on delivering steady, measurable results while building lasting trust. We go beyond numbers by understanding your personal finances and providing reliable support to help you reach your goals with confidence and ease.

Why us?

Get Clarity

What You Have

How You Grow

What’s Next

Clarity Over Complexity, Personalized Strategies, Transparent Guidance, Proven Expertise, End-to-End Support

Empowering Our Clients

Testimonials

Trust Builds Us. Results Define Us.

“We create lasting relationships rooted in trust, clarity, and results. Curious about what that journey looks like? See how our clients describe their experience working with us.”

FAQs

Frequently Asked Questions

What does a Financial Planning Advisor at Magnus Advisory do?

At Magnus Advisory, a Financial Planning Advisor helps individuals to work out a budget, invest, plan their retirement, insurance, and taxing. They will customize the strategies to meet your values and life goals, and financial situation.

What services are included under financial planning with Magnus?

Magnus provides a wide range of services, i.e.

Guaranteed Savings Plan ,Retirement Planning, Children Education Planning, Universal Life Insurance, Structured Notes Investment, Trade instruments, Citizenship by investment, Single Lump Sum Investments and Relocation of Neglected Policies.

Does Magnus only deal with the local clients in UAE?

No. Magnus Advisory is based in Dubai, and has a huge global client base especially expatriates and international families and offers solutions on the issues and interests addressing cross-border wealth, tax and investment.

How do I get started with Magnus Advisory?

One just needs to call via the Contact Us page and make a consultation. You choose the area (UAE, India, UK, Kenya) and the best time. That is where you can be processed through the easier onboarding process with a client relationship manager as part of the advisory-led experience.

Does Magnus Advisory manage after sales duties?

Yes. Magnus Advisory is fully committed to post-sales delivery as this is part of its effort to play the role of a trusted financial planning advisor in Dubai. Once a plan or solution is put into place, they offer continual customer service such as solving of problems, follow-ups, support of modifications as well as continuity of the strategy to ensure that your financial plan is always on track in accordance with the changing conditions.